Changes to Capital Gains Tax: What do I need to know?

Jeremy Hunt’s Autumn 2022 statement announced a reduction in Capital Gains allowances, effective from 1st April 2023, with further changes taking place from April 2024. This change in thresholds and allowances can have a significant impact on landlords and individuals looking to benefit from releasing equity from their investments and assets over the coming 2 years. However, we at Castelnau explain below how these changes will effect property investors of all sizes and how we can work together to reduce exposure and maximise the sale of existing assets.

The basics:

“Capital Gains” is a term used to describe profits earned from investments. This can include profits earnt from buying and selling art, stocks and shares, or, in this case, property. Capital Gains Tax (or CGT) is the tax applied on those investment profits.

CGT is calculated on the profit made from the sale, not the total price of the sale. For example, if a property was purchased for £250,000 and sold 3 years later for £270,000 the Capital Gain is £20,000, therefore the tax rate will be applied to £20,000.

The 2023 tax changes:

Until 1st April 2023, the CGT allowance was £12,300. However, from 1st April, this allowance will more than halve to only £6,000.

In addition, the current budget includes further reductions to this allowance for 2024, halving the figure again to £3,000.

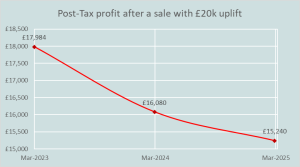

These upcoming changes are demonstrated below using an example of a property bought at £250,000 and sold at £270,000:

As demonstrated above, the reduction of Capital Gains allowance means investors would walk away with less profit from their sale in 2025, than they will by selling their property in 2023. If looking at the sale of one location, this change may not ring alarm bells, but when applied to larger portfolio sales, or multi-unit sales, this difference in take home profit would certainly be noticeable.

The obvious caveat to this though, is the classical expectation for property price growth to offset this decrease in take home earnings. However, as seen in the below data (Source: HMLR), house prices have fallen into negative growth territory and there aren’t many signs of them returning to prior highs any time soon.

Many economists credit this phenomenon to excess inflation and the subsequent interest rises that followed making houses less affordable and mortgages more expensive. Home buyers have found themselves priced out of the market as they fail to pass affordability tests. Buy-to-let landlords have been forced to sell their investment properties as the rental income no longer covers mortgage repayments. Would-be renters are priced out from the rental market, making interest-covering rent even harder to achieve for BTL landlords (ONS Data: Young adults living with parents).

The impact:

The net effect of this, is a decrease in residential property prices. Given that there are no obvious signs of general price levels returning to normal, or of interest rates coming down any time soon , it would appear that over the next 2-3 years the housing market would be set to continue its marginal decline, or stagnate at best, leaving property sellers in the claws of a two-pronged attack: uncertain capital appreciation and an increased tax burden.

How to maximise your position:

As an established long-term property investor acquiring over 10,000 units and deploying over £100m, Castelnau has procured the experience and expertise to structure transactions in the most tax-efficient manner.

Castelnau meticulously plans each transaction, tailoring the solution to the individual situations to ensure a beneficial outcome for all parties.